In probability theory, a log-t distribution or log-Student t distribution is a probability distribution of a random variable whose logarithm is distributed in accordance with a Student's t-distribution. If X is a random variable with a Student's t-distribution, then Y = exp(X) has a log-t distribution; likewise, if Y has a log-t distribution, then X = log(Y) has a Student's t-distribution.

Characterization

The log-t distribution has the probability density function:

- ,

where is the location parameter of the underlying (non-standardized) Student's t-distribution, is the scale parameter of the underlying (non-standardized) Student's t-distribution, and is the number of degrees of freedom of the underlying Student's t-distribution. If and then the underlying distribution is the standardized Student's t-distribution.

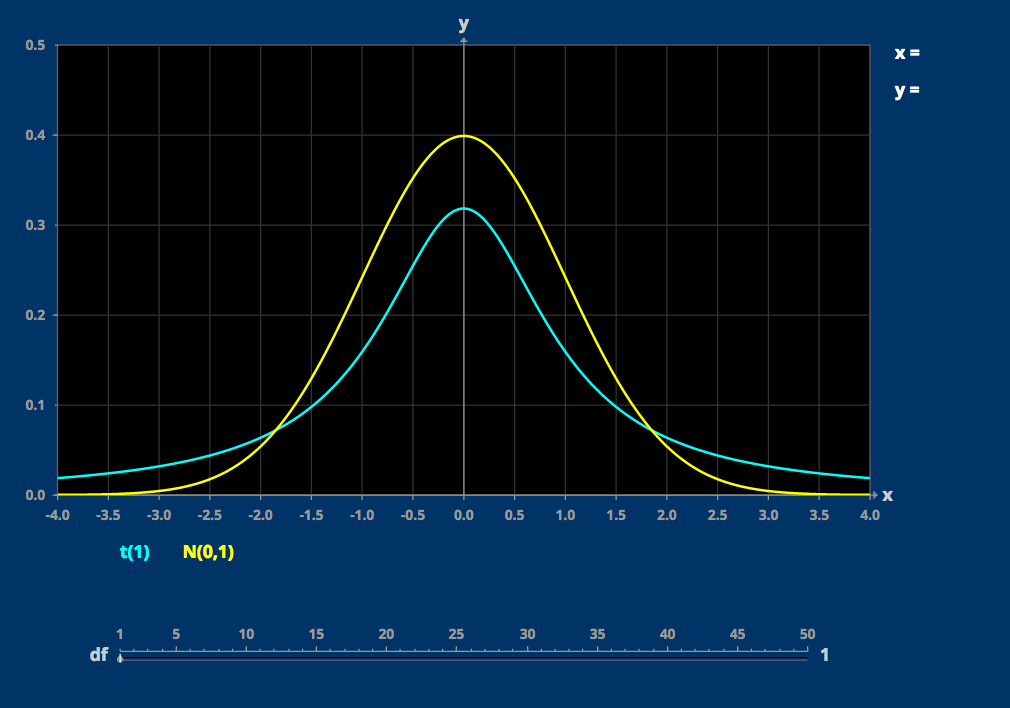

If then the distribution is a log-Cauchy distribution. As approaches infinity, the distribution approaches a log-normal distribution. Although the log-normal distribution has finite moments, for any finite degrees of freedom, the mean and variance and all higher moments of the log-t distribution are infinite or do not exist.

The log-t distribution is a special case of the generalized beta distribution of the second kind. The log-t distribution is an example of a compound probability distribution between the lognormal distribution and inverse gamma distribution whereby the variance parameter of the lognormal distribution is a random variable distributed according to an inverse gamma distribution.

Applications

The log-t distribution has applications in finance. For example, the distribution of stock market returns often shows fatter tails than a normal distribution, and thus tends to fit a Student's t-distribution better than a normal distribution. While the Black-Scholes model based on the log-normal distribution is often used to price stock options, option pricing formulas based on the log-t distribution can be a preferable alternative if the returns have fat tails. The fact that the log-t distribution has infinite mean is a problem when using it to value options, but there are techniques to overcome that limitation, such as by truncating the probability density function at some arbitrary large value.

The log-t distribution also has applications in hydrology and in analyzing data on cancer remission.

Multivariate log-t distribution

Analogous to the log-normal distribution, multivariate forms of the log-t distribution exist. In this case, the location parameter is replaced by a vector μ, the scale parameter is replaced by a matrix Σ.

References

:max_bytes(150000):strip_icc()/dotdash_Final_Log_Normal_Distribution_Nov_2020-01-fa015519559f4b128fef786c51841fb9.jpg)